Understanding health insurance deductibles and copays is crucial for making informed decisions about your coverage. Many people pay high premiums but don’t fully understand how deductibles, copays, and coinsurance affect their out-of-pocket costs. This guide provides a detailed explanation of these terms, examples, tips for saving money, and informative tables to make it easy to grasp.

1. What Are Deductibles?

A deductible is the amount you must pay out of pocket for covered healthcare services before your insurance starts to pay.

| Term | Definition |

|---|---|

| Deductible | Amount you pay before insurance covers costs |

| In-Network Deductible | Applies when using healthcare providers within your insurance network |

| Out-of-Network Deductible | Usually higher; applies to providers outside your network |

Example: If your plan has a $1,500 deductible, you must pay $1,500 in medical bills before your insurance begins to cover costs.

Tip: Higher deductibles usually mean lower monthly premiums but higher risk if you need care frequently.

For more on health insurance basics, see Healthcare.gov: Health Insurance Terms.

2. What Are Copays?

A copay is a fixed fee you pay for a specific service after your deductible is met (or sometimes before).

| Service Type | Typical Copay | Notes |

|---|---|---|

| Primary Care Visit | $10–$30 | Flat fee per visit |

| Specialist Visit | $25–$50 | Often higher than primary care |

| Emergency Room | $75–$150 | May be waived if admitted |

| Prescription Drugs | $10–$50 | Tiered by generic or brand |

Example: If your doctor’s visit copay is $25, you pay $25 per visit regardless of the service cost.

3. Coinsurance Explained

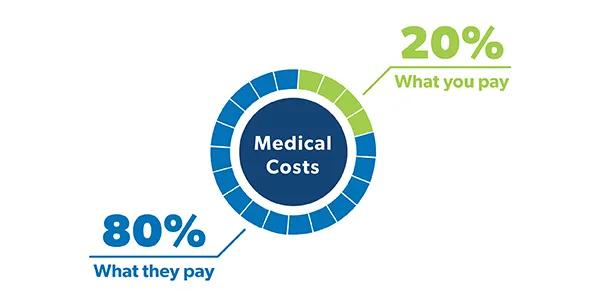

Coinsurance is the percentage of medical costs you pay after meeting your deductible.

| Term | Definition | Example |

|---|---|---|

| Coinsurance | Your share of costs (percentage) | 20% coinsurance on a $1,000 bill = $200 |

| Out-of-Pocket Maximum | Maximum you pay in a year | After reaching it, insurance pays 100% |

Tip: Knowing your coinsurance percentage helps you anticipate potential medical expenses.

4. How Deductibles, Copays, and Coinsurance Work Together

The interaction can be confusing. Here’s a simple example:

| Step | Cost | Explanation |

|---|---|---|

| 1 | $1,500 | Deductible paid by you |

| 2 | $200 | Copay for specialist visit |

| 3 | $1,000 | Coinsurance applies (20% = $200) |

| 4 | $500 | Insurance pays the remaining $400, you pay $100 more until out-of-pocket max |

Tip: Use a table like this to track your total yearly healthcare spending and plan savings accordingly.

5. Strategies to Minimize Costs

| Strategy | How It Saves Money |

|---|---|

| Choose higher deductible plans | Lower monthly premiums |

| Use in-network providers | Lower deductibles, copays, and coinsurance |

| Utilize preventive care | Often fully covered before deductible |

| Compare prescription costs | Choose generic drugs or mail-order programs |

| Track out-of-pocket expenses | Avoid exceeding your budget |

6. Employer vs. Individual Plans

- Employer Plans: Often subsidized, may include Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs)

- Individual Plans: Premiums, deductibles, and copays vary widely; you may be eligible for tax credits

Tip: If you have access to an HSA, contribute enough to cover your deductible for tax-free savings.

7. Understanding Out-of-Pocket Maximums

Your out-of-pocket maximum is the most you pay in a year for covered services. After this limit, insurance covers 100%.

| Term | Typical Range | Includes |

|---|---|---|

| Individual | $3,000–$9,000 | Deductible, copays, coinsurance |

| Family | $6,000–$18,000 | Sum for all family members |

Tip: Knowing your out-of-pocket max helps protect against catastrophic medical costs.

8. Choosing the Right Plan

When selecting a health insurance plan:

- Evaluate deductibles, copays, and coinsurance together

- Consider monthly premiums vs. potential out-of-pocket costs

- Review network coverage

- Compare prescription coverage and specialist access

Table: Sample Comparison of Three Plans

| Plan | Monthly Premium | Deductible | Copay | Coinsurance | Out-of-Pocket Max |

|---|---|---|---|---|---|

| Bronze | $300 | $5,000 | $40 | 30% | $8,000 |

| Silver | $450 | $2,500 | $30 | 20% | $5,000 |

| Gold | $600 | $1,000 | $20 | 10% | $3,000 |

9. Common Mistakes to Avoid

- Assuming deductible = total cost

- Ignoring coinsurance and copays

- Failing to verify if providers are in-network

- Not tracking out-of-pocket expenses for tax purposes

Tip: Review plan details annually and update coverage as healthcare needs change.

10. Special Considerations

- High-Deductible Health Plans (HDHPs): Pair with HSAs to save pre-tax dollars

- Family Coverage: Check if dependents’ deductibles are combined or separate

- Preventive Services: Often covered 100%, even before deductible

11. Summary

Understanding deductibles, copays, and coinsurance helps you choose the best plan, budget for healthcare costs, and avoid unexpected expenses. By carefully evaluating premiums, deductibles, and out-of-pocket maximums, you can maximize value from your insurance coverage.

For further guidance on health insurance terms and planning, see HealthCare.gov Glossary.